colorado paycheck calculator hourly

Instant Email If you are on a tablet or phone and you cant download we can email it to you also. Download a PDF Report.

How Much Does Petal Pay In 2022 80 Salaries Glassdoor

Instant Download If you like the preview you can download the PDF to print to see if you like it.

. You pay half when youre employed and your employer is obligated to pay the other half but youre considered both employer and employee when youre self-employed. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information. Calculate your Colorado net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Colorado paycheck calculator.

Although the FLSA has not set restrictions for 16 17 year olds over half of the states have work hours meal breaks or rest period laws specific to minors. This hourly wage calculator helps you find out your annual monthly daily or hourly paycheck having regard to how much you are working per day week and pay rate. If all you need is a hard copy of your free work hours calculator report just use the Print This button and youre ready to send it off to your accounting department or store it as a permanent record.

By this scenario the gross paycheck formulas applied depend on the way the normal pay rate is specified as detailed below. Federal prevailing wage laws are just thatlaws. Instant Preview No software or download any install.

If you break these laws youll likely face penalties and finesand thats on top of the back pay youll owe the workers you underpaid. This handy calculator lets you plug in your expenses for recruiting benefits salaries and more. Checked for accuracy on 562022.

Why is it important to understand prevailing wage as a business owner. However if you wish to have a copy of your timesheet employee attendance. Switch to Colorado salary calculator.

Overview of Federal Taxes When your employer calculates your take-home pay they will withhold money for federal and state income taxes and two federal programs. Numerical values are consistent with living wage 2021 estimates published on 51222. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes.

Just type in your info and preview on screen. While the minimum wage sets an earnings threshold under which our society is unwilling to let families slip it fails to ap. An employer may deduct from a final paycheck the cost of a uniform tools or equipment not returned by a terminated employee within a reasonable time if the employee gave the employer prior written authorization to do so and if the employer.

The Federal Labor and Standards Act sets hour restrictions for 14 15 year olds. While it might be tempting to lower the cost of payroll by paying workers less its not a good idea. State Taxes Itemized and separate state taxes for all the greater 50.

The self-employment tax is your FICA taxesthe Medicare and Social Security taxes that your employer would normally withhold from your paychecks in addition to income tax. Switch to Colorado hourly calculator. EXPORTING THE WORK HOURS CALCULATOR DATA.

This Colorado hourly paycheck calculator is perfect for those who are paid on an hourly basis.

New York Paycheck Calculator Adp

Hourly Paycheck Calculator Calculate Hourly Pay Adp

What If Your Biggest Competitor For Ftic Enrollment Is Target

Hourly Paycheck Calculator Calculate Hourly Pay Adp

Hourly Paycheck Calculator Template Google Docs Google Sheets Excel Word Apple Numbers Apple Pages Template Net Paycheck Templates Calculator

New York Paycheck Calculator Adp

Hourly Paycheck Calculator Calculate Hourly Pay Adp

California Paycheck Calculator Adp

Landscape Architect Salary Comparably

Free Employer Payroll Calculator And 2022 Tax Rates Onpay

Robert Half Cto Drills Down On Key Features And Ai Technology In Award Winning Mobile App It World Canada News

Paycheck Calculator Michigan Mi Hourly Salary

Maryland Paycheck Calculator Adp

Paycheck Tax Withholding Calculator For W 4 Tax Planning

Free Employer Payroll Calculator And 2022 Tax Rates Onpay

Paycheck Tax Withholding Calculator For W 4 Tax Planning

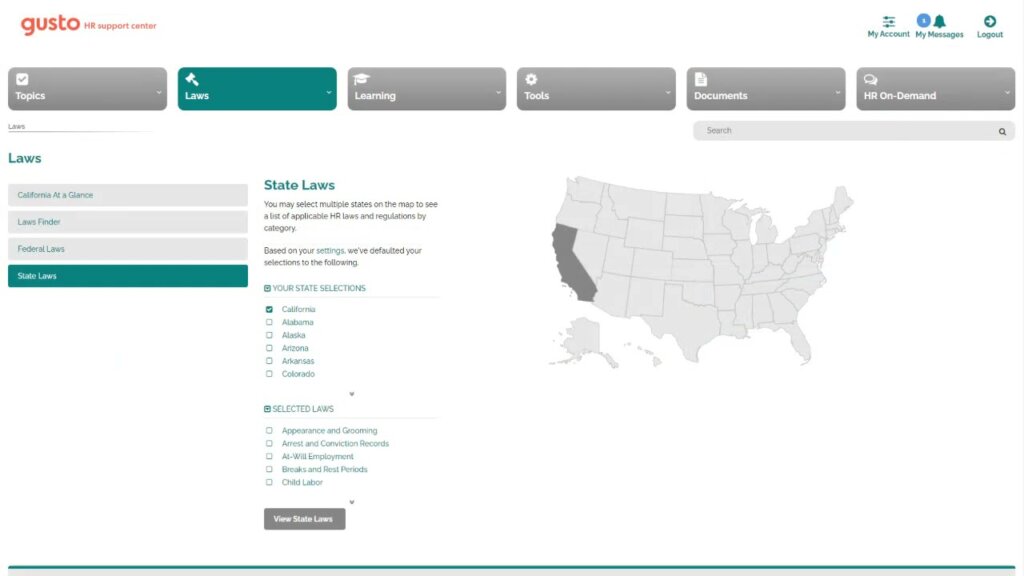

Gusto Review Solid Payroll Software Mixed With Time Management